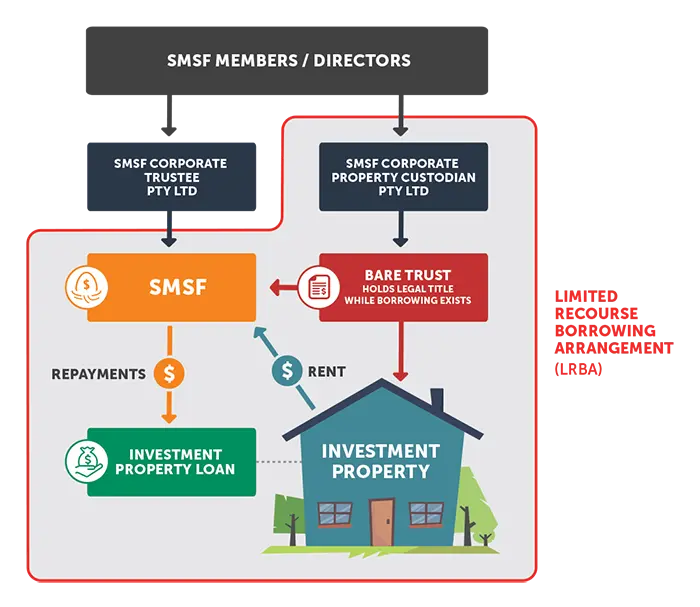

“Our market-leading SMSF product increases your borrowing potential, requiring only a minimum 20% deposit for residential and commercial property.

This means you can keep more of your funds or place them in the optional offset account for quick access later.

With the sharpest rates, low fees and excellent service, we’re making it easier than ever to purchase property through your SMSF.”

We are able to finance 80% LVR loan with the best facility in the market